THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

And having one that is hassle free and offers high paying interest accounts is icing on the cake.

This is Ally Bank.

With a simple to use online banking interface, great products, excellent customer service and high interest paying accounts, Ally Bank is a great bank to work with.

In this Ally Bank review, I highlight the best accounts Ally offers and what makes them stand out from the rest.

Ally Bank Review

- Features

- Ease of Use

- Account Fees

- Customer Service

Summary

Ally Bank is one of the best online banks to choose from. With great customer service and high interest paying accounts, you can't go wrong by choosing this bank.

Table of Contents

Ally Bank Review | One Of The Best Online Banks

Who Is Ally Bank?

Ally Bank is owned by Ally Financial, which has roots back to 1919.

Back then, its primary business was auto financing and over the years, became involved in other financial services.

In 2008, GMAC was granted permission to create a bank holding company and Ally Bank was born.

Today, it is one of the largest banks in the country and consistently ranks as one of the highest interest paying banks.

It also ranks highly for ease of use and customer service.

Below are the most popular banking products Ally offers.

Ally Checking

The checking account that Ally offers is one of the best.

Not only is there no minimum balance required to open an account, there are no maintenance fees either.

You have access to over 43,000 ATMs nationwide to withdraw your money, and Ally won’t charge you a fee for using one.

If the other bank does, Ally will reimburse you up to $10 per statement cycle.

In addition to the above, Ally Checking pays interest.

The more you have in your account, the higher the interest rate you earn, but you earn interest even if you have $1.00 in your account.

And with the Ally Bank mobile app, you can deposit checks from anywhere and make transfers fast.

Ally Savings

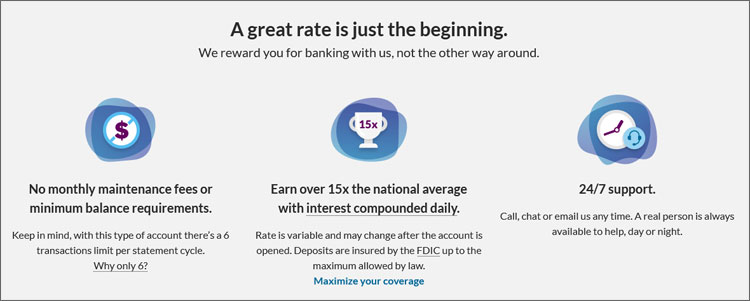

Ally Savings account is just as great as the checking account.

For starters, it also comes with zero fees and no minimum to open.

You earn one of the highest interest rates, regardless of your balance. There is no tiered system where you earn a lower interest rate on smaller balances.

All balances earn the same rate.

Finally, you have the option to open multiple savings accounts as well.

This is great for people looking to save for multiple goals and don’t want to combine their money into one account.

You can also use their mobile app to make transfers on the go and set up recurring transfers as well.

Ally CDs

If you are interested in certificates of deposit, Ally has you covered.

They have 3 different types of CDs to choose from:

- High Yield CD

- Raise Your Rate CD

- No Penalty CD

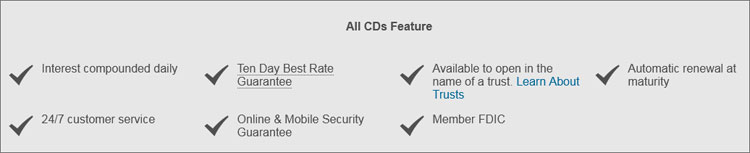

All CDs have interest compound daily and they all automatically renew at maturity.

Ally also offers a 10 Day Best Rate Guarantee on all of their CDs, so you are certain to get the highest rate on your savings.

The CDs are offered in various terms from 3 months up to 5 years. However, not all terms are available for each CD.

For example, with the No Penalty CD, you can only choose an 11 month term.

Ally Invest

Ally Invest is a way for those looking to grow their long term savings.

There are 2 investment options available, self-directed trading and managed portfolios.

Self-directed trading is perfect for do it yourself investors and leans more towards active investors.

The tools and research Ally Invest offers is top notch.

For investors who need a little hand holding, there are managed portfolios.

Here Ally will invest your money into a portfolio based on your risk aversion, goals, and time horizon. You just sit back and let Ally Invest do the work for you.

If you want to learn more about Ally Invest, click here.

Advantages And Drawbacks

There are advantages and drawbacks to everything in life. Ally Bank is no different.

Here are the biggest advantages and drawbacks that I see Ally Bank has.

Advantages

High savings interest rate. Ally Bank consistently offers one of the highest interest rates on its savings accounts. No need to jump through hoops either. You earn the same rate regardless of your balance.

Interest on checking. Ally offers interest on your checking account. While the rate isn’t as high as their savings account, it is nice since most banks don’t offer interest on checking accounts. Also, you earn interest regardless of your balance.

No fees. Ally Bank does not charge any monthly fees or require a minimum balance.

Multiple savings accounts. If you like to have multiple savings accounts for each of your savings goals, Ally lets you have multiple savings accounts.

Great web experience. The website is laid out nicely, making it easy to do what you want.

Customer service. The customer service with Ally is top-notch. They are also available to answer your questions 24/7.

Drawbacks

No branches. There are no branches to walk into. All of your banking is done online, over the phone, or through the mail.

No cash deposits. Since all banking is done electronically, over the phone or through the mail, you cannot deposit cash with Ally.

Savings withdraws. As with most other banks, you can only make 6 withdraws or external transfers a month. After this, there is a $10 fee.

Frequently Asked Questions

Is Ally Bank safe?

Yes, Ally Bank is safe.

As of this writing, it is the 19th largest bank in the United States based on assets, and serves over 6 million customers.

Your money is also insured by the Federal Deposit Insurance Corporation for up to $250,000.

Is my information secure?

Ally takes your personal security serious.

They use the latest encryption and firewall technology and constantly review and update their systems and processes.

Of course, there are times when your device gets compromised and a hacker gains access this way.

In this case, Ally offers a guarantee that you will not be liable for any unauthorized transaction as long as you notify them within 60 days.

Additionally, they offer Webroot Security software for 3 of your devices to help you avoid getting attacked.

Who is Ally Bank owned by?

Ally Bank is owned by Ally Financial, its parent company.

The bank was created in 2008, but before that, the owner, GMAC was involved in various financial activities, including auto lending and real estate.

Does Ally Bank have ATMs?

Ally Bank does not have any branded ATMs. However, they are part of the Allpoint network.

This means you can use any of the more than 43,000 Allpoint ATMs nationwide.

While Ally does not charge you any fees for using the ATM, the bank that runs the ATM may.

Don’t worry though as Ally reimburses you up to $10 in ATM fees per statement cycle.

Does Ally Bank have any branches?

There are no physical branches with Ally Bank.

All of your banking is done online, over the phone, or through the mail.

Can I deposit cash with Ally Bank?

Since there are no branches, you cannot deposit cash with Ally.

You could give the cash to a friend and have them write a check, which you then deposit using the mobile app.

Another option would be to deposit the cash in another bank you have an account with and then make an online transfer.

Alternatives to Ally Bank

There are a lot of banks out there, but not many can directly compete with what Ally is offering.

Below I highlight a couple of banking alternatives that go head to head with Ally.

CIT Bank

CIT Bank is another online only bank that offers a high interest rate on its savings account.

They also recently began to offer a checking account, so they can be your main banking option.

What makes CIT Bank stand out is the great layout of their website, responsive customer service, and the high interest they pay.

Betterment Everyday

Betterment Everyday is a new player to the banking world.

The investing firm Betterment wants to be your sole financial institution, so they partnered with a handful of banks to offer both a checking and a savings account.

They offer high interest rates on their banking products as well as many other benefits traditional banks cannot match.

Capital One 360

Capital One 360 is another one stop banking option.

Like Ally, they offer everything you need for a complete banking experience.

The interest they pay on their checking account rivals Ally, however, the interest on their savings account is a little less.

But the ease of online banking with Capital One 360 cannot be overlooked.

They also offer a $25 bonus on new accounts.

Final Thoughts

At the end of the day, Ally Bank is a great option for your banking needs.

I’ve been a customer for over 5 years now and never had an issue.

Everything works like it is supposed to and I am happy with the higher than average interest I earn on my money.

If you are looking for a complete banking solution or simply an online savings account, Ally Bank should be on your short list.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.